Recent headlines around Trump’s renewed focus on Greenland and potential tariff actions involving Europe have put trade tensions back on the market’s radar.

Traders are watching closely because history shows that trade policy shifts rarely stay contained within geopolitics. They often ripple through stocks, currencies, and safe-haven assets like gold.

While the situation is still evolving, traders are not reacting to politics itself. They are assessing how these developments could influence supply chains, inflation expectations, and market sentiment in 2026.

This article breaks down:

- Why Greenland and tariffs matter for markets

- How stocks and gold have historically reacted to tariff tension

- Which stocks are drawing attention now

- What traders are watching next

Why Greenland and Tariffs Matter to Markets

Greenland sits at the crossroads of strategic shipping routes, natural resources, and geopolitical influence. When tariffs gets in the mix, markets interpret this as more than symbolism.

Tariffs tend to affect markets through three main channels:

- Inflation expectations, as import costs rise

- Corporate margins, due to higher input expenses

- Global trade confidence, which influences risk sentiment

That is why Trump’s Greenland tariff move has caught traders’ attention. Not because of immediate policy changes, but because it introduces trade uncertainty at a sensitive point in the broader macro cycle.

How Stocks Have Reacted to Tariffs in the Past

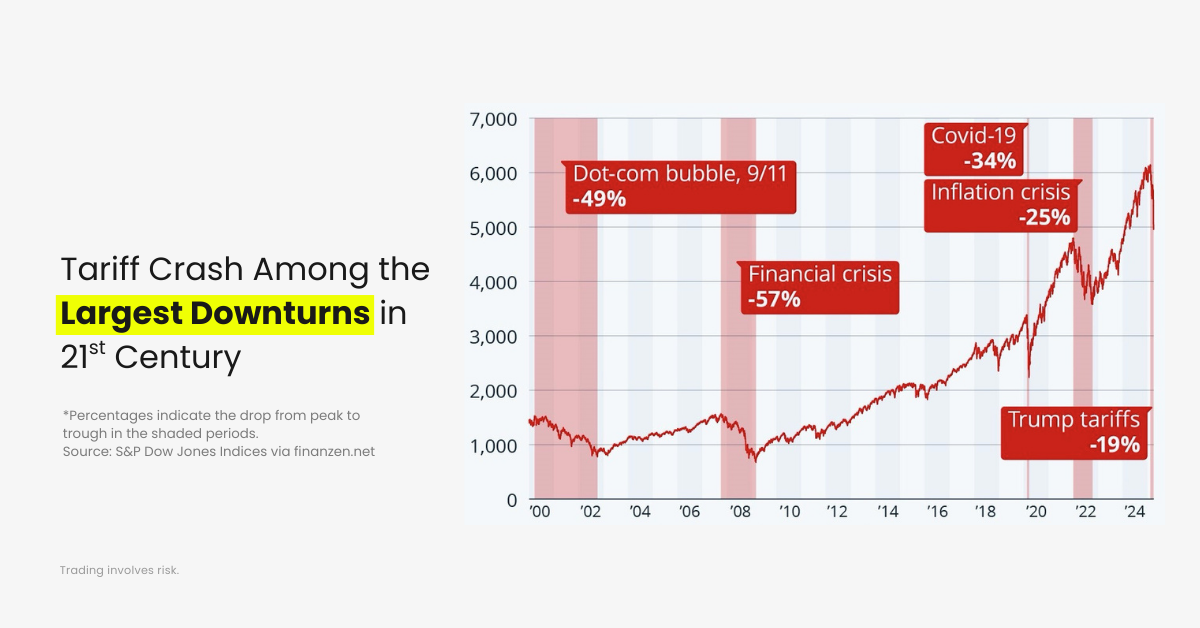

Historical data shows that tariff-related episodes have often coincided with notable equity drawdowns.

During the first wave of Trump-era tariffs, the S&P 500 fell by nearly 20% at its peak. The move was driven less by immediate economic damage and more by rising uncertainty around supply chains, inflation, and global growth.

Importantly, markets reacted before policy details were fully known, highlighting how trade uncertainty alone can act as a meaningful stress factor for equities.

Now, with tariff discussions resurfacing again, a similar question is emerging among traders:

Could markets react in a familiar way, or has the backdrop changed enough this time?

Unlike the earlier episode, today’s environment includes:

- Higher starting valuations

- Greater sensitivity to inflation

- Stronger dependence on global supply chains

- An active role for central banks in shaping sentiment

Rather than assuming history will repeat exactly, traders are watching whether uncertainty itself becomes the catalyst, just as it did before.

3 Stocks in Focus After Trump’s Greenland Tariff Move

Rather than broad generalizations, markets tend to focus on specific companies with clear exposure when tariff risks appear.

Apple (AAPL)

Apple’s global manufacturing footprint makes it sensitive to trade developments. Changes in tariff policy can affect:

- Component costs

- Supply chain efficiency

- Pricing strategies

Even without direct policy action, trade headlines alone have historically influenced sentiment around Apple shares.

Boeing (BA)

Boeing operates within one of the most globally interconnected industries. Aircraft manufacturing relies on:

- Cross-border suppliers

- International customers

- Government-to-government trade agreements

Tariff uncertainty can affect order flows and negotiations, which is why Boeing often appears on traders’ radar during trade discussions.

Caterpillar (CAT)

Caterpillar is closely tied to global industrial demand and infrastructure spending. Tariffs can influence:

- Export competitiveness

- Input costs

- Demand from overseas buyers

When trade friction rises, industrial exporters like Caterpillar are often among the first stocks reassessed by markets.

How Gold Typically Reacts to Tariffs

Gold often reacts differently than stocks during tariff uncertainty.

When trade tensions rise:

- Growth expectations can soften

- Policy risks increase

- Demand for assets outside the banking system can strengthen

Gold is not reacting to tariffs alone. It is responding to a broader mix of interest-rate expectations, currency movements, and geopolitical risk

That is why gold frequently moves into focus during trade-related headlines, even if tariffs are not immediately implemented.

Why This Matters for 2026 Market Expectations

As markets look ahead, trade policy is one of several variables shaping the outlook.

If tariffs remain a talking point without follow-through, markets may absorb the noise.

If trade pressure begins influencing inflation or growth expectations, volatility could rise quickly.

For traders, this is less about prediction and more about awareness.

Understanding how trade signals interact with macro conditions helps explain why markets move the way they do.

And in periods like this, understanding the story often matters more than reacting to the headline.

Risk Disclosure

Trading in Securities, Futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance and D Prime and its affiliates give no assurance that any views, projections, or forecasts will materialize.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness or reliability of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial trading or investment decisions.